Getting My Federated Funding Partners To Work

Table of ContentsThe Buzz on Federated Funding Partners LegitMore About Federated Funding Partners ReviewsThe Federated Funding Partners DiariesFederated Funding Partners Reviews Things To Know Before You Get ThisFederated Funding Partners Reviews for Dummies

Financial obligation debt consolidation loans will usually allow higher levels of borrowing than charge card equilibrium transfer alternatives as well as reduced interest prices than many credit report cards. You will certainly wish to be particular that the car loan's monthly settlements are less than your existing total minimum month-to-month credit rating card repayments, along with a lower passion price - federated funding partners reviews.

Rumored Buzz on Federated Funding Partners Reviews

A negative credit score use proportion might cause your credit rating to drop. Make a monthly credit report evaluation day Preparation for the future isn't exciting, however residing in the future with your wide range will be. Allot eventually a month to draw out your account declarations, credit scores card declarations, as well as credit scores record as well as take stock of your accounts.

With the higher credit rating that come with financial obligation repayment, you'll begin to earn approval for benefits cards that use either money back, traveling discount rates, or gifts. Truth indicator of fantastic credit scores is when you spend less than what you gain.

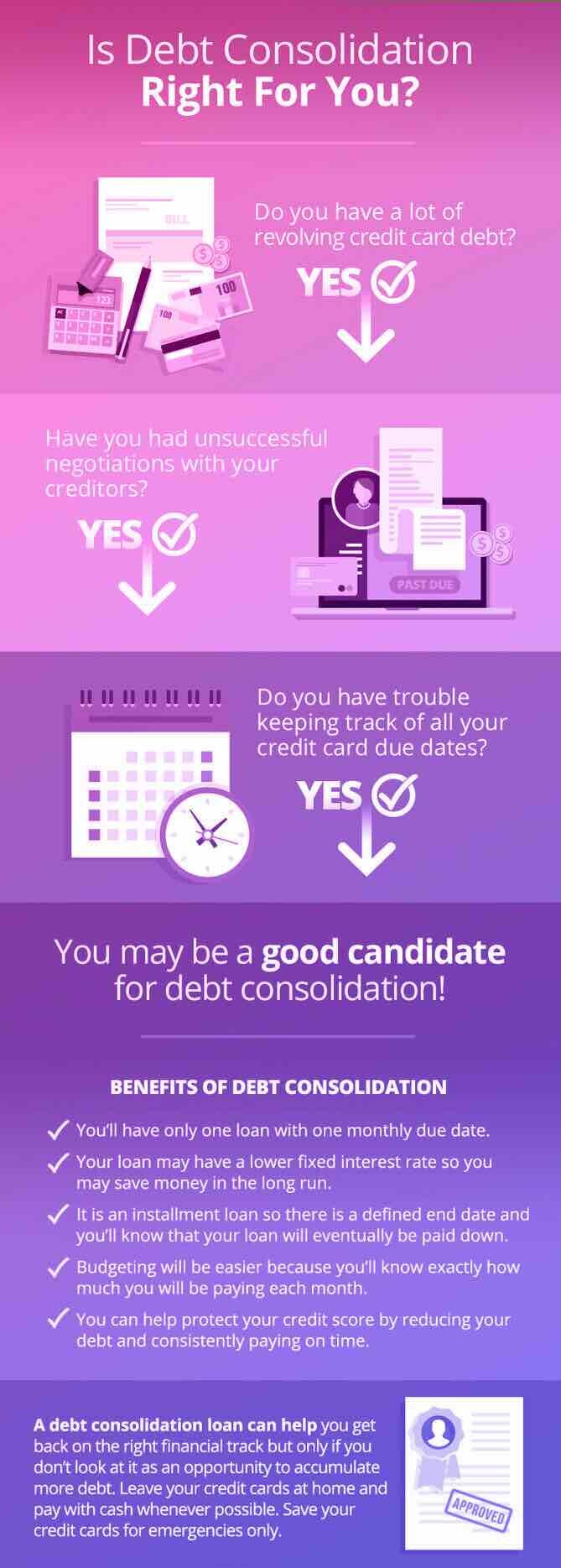

Before continuing with a financial debt combination funding, it is crucial that you understand all elements of it. Below is a listing of both the benefits as well as disadvantages of debt consolidation lendings.

Additionally, with several payments debtors frequently acquire a substantial amount of rate of interest when they are not able to repay each specific financial obligation whereas with a financial debt consolidation finance there is simply one easy settlement, so rates of interest will likely be reduced each month.: financial debt loan consolidation lending rates of interest have a tendency to be less than bank card rates, so you conserve cash as well as settle your financial obligations faster.

See This Report about Federated Funding Partners Reviews

In fact, since you have actually minimized your interest settlements, it is possible that your debt ranking will actually improve as an outcome of your new debt consolidation funding. Disadvantages of a Financial Obligation Combination Lending To get a debt loan consolidation finance, you might be required to provide some kind of security.

If you are unable to make your loan repayments, you take the chance of losing your vehicle, residence, or family items (federated funding partners reviews). Although you can possibly conserve with a lowered rates of interest, integrating of your old financial obligations right into one debt combination funding will certainly still leave you with a big month-to-month settlement. If you had trouble making your payments on three or 4 tiny financings, you might still have.

If you owe even more than you can take care of, a financial obligation combination finance is an option certainly worth considering. Remember, however, that you have various other choices also, such as credit history counseling, a consumer proposition, or personal bankruptcy, so we recommend you assess every one of your alternatives click here now and afterwards decide which alternative is appropriate for you.

Battling to handle your financial obligation settlements? Settling your financial debt can be a wonderful method to simplify your financial resources and also bring your month-to-month spending under control.

Unknown Facts About Federated Funding Partners Legit

The advantage of debt loan consolidation is generally some mix of the following: Fewer regular monthly repayments to manage Lower total passion costs Smaller sized overall regular monthly payment Lower overall cost to pay off all financial debts In other words, financial obligation combination must make your life less complicated as well as conserve you federated funding partners reviews cash. Obviously, that's not a warranty.

Below are what may be taken into consideration the 6 most usual techniques: Unsecured consolidation loan You can obtain an unsafe finance from your banks of selection and use the funds to settle your exceptional debts. You'll then be repaying the loan every month rather of your old debts. Home equity lending If you have equity in your house, you can get a car loan versus that equity and use the funds to settle your financial debts.

Financial debt monitoring plan Working with a not-for-profit credit score counseling company, you can enroll in a financial obligation administration strategy. Here you'll make one payment every month to the company, which will certainly make creditor repayments on your part. This is not a car loan, yet most financial institutions will certainly offer decreased rate of interest and also various other rewards for paying off with a financial obligation administration strategy.

Discover much more regarding credit report and also financial debt consolidation: Next steps Any type of lingering concerns regarding debt loan consolidation? If you have a peek at this website have inquiries regarding debt, credit rating, and individual expenditures, they have the assistance and sources you require.

Indicators on Federated Funding Partners Bbb You Need To Know

When you got your first charge card, you had no trouble making the monthly repayment. But prior to you recognized it, you had actually maxed out the very first card and taken out other cards to pay for a financial emergency situation. Instantly a convenient regular monthly payment became an unmanageable financial obligation. Should you try a debt consolidation car loan? Debt combination loans integrate all unsecured financial obligation right into one finance and also one month-to-month settlement.